Artificial intelligence (AI) refers to a variety of computer operations that would otherwise require human intelligence. AI and its variation called machine learning (ML) are making waves across several sectors of the healthcare industry.

Some of the potential applications in healthcare include earlier disease detection, more accurate diagnosis, pattern recognition in medical imaging, robot-assisted surgery, triaging, clinical trial management, hospital workflow assistance, fraud detection, dose error reduction, virtual/remote monitoring and assistance, and development of personalized diagnostics and therapeutics.

One of the biggest problems faced by medical practitioners today is the inability to go through the sheer volume of healthcare records, such as radiological images, labs, exam reports, and data obtained from monitoring and compliance devices. Interestingly, medical imaging alone is estimated to account for 90% of all healthcare data. Hospitals store millions of digital images. As the scanners become better at capturing thinner slices and complex 3D/4D visualizations become commonplace, medical imaging represents the biggest opportunity in healthcare for disruption by AI.

Artificial intelligence in medical imaging is expected to substantially to enhance patient outcomes because of its ability to analyze large datasets and extract meaningful insights for the radiologist. The initial fear that AI would replace radiologists has evolved towards radiologists embracing its power to improve a patient’s experience.

AI-based solutions in radiology include computer aided detection, computer aided diagnosis, image acquisition and analysis, decision support, workflow support, intelligent medical machines, and enterprise imaging. Artificial intelligence has the potential to augment the entire radiology workflow starting from image acquisition to final treatment/prognosis.

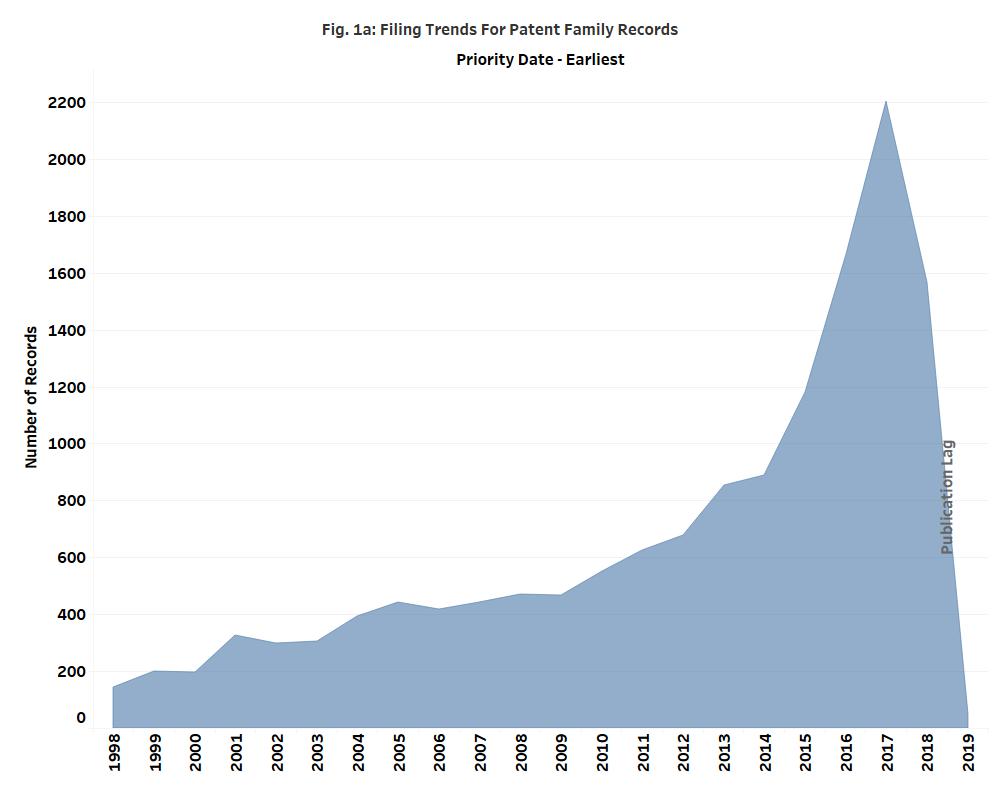

We analyzed the patent families related to AI and medical imaging for the period of Jan 1, 1998 to May 15, 2019. The patent filings in the space have increased exponentially, since 2014 (Fig. 1a).

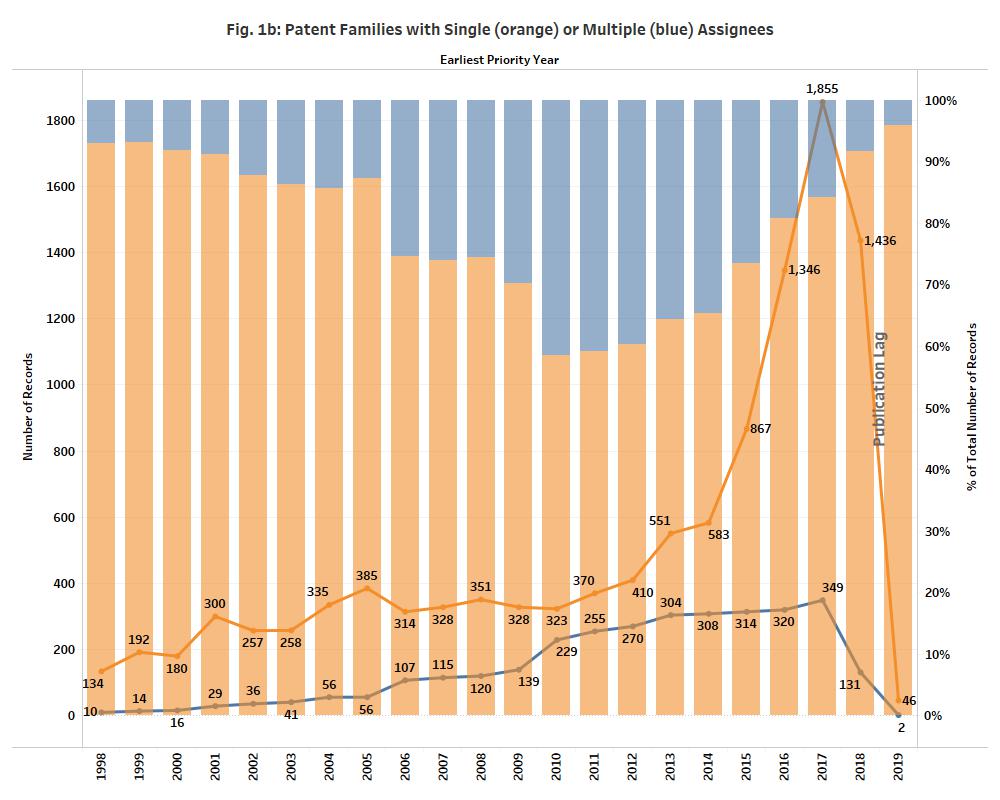

Patent families associated with multiple assignees showed a steady increase in the number of filings from 1998 through 2014 then rise sharply, peaking in 2017 (Fig. 1b, blue line). This suggests an early period of collaborative efforts, which are then dwarfed by entities seeking increased patent filings on their own, in the last five years, as evidenced by the steady drop in percentage of applications filed with multiple assignees (Fig. 1b, blue bar).

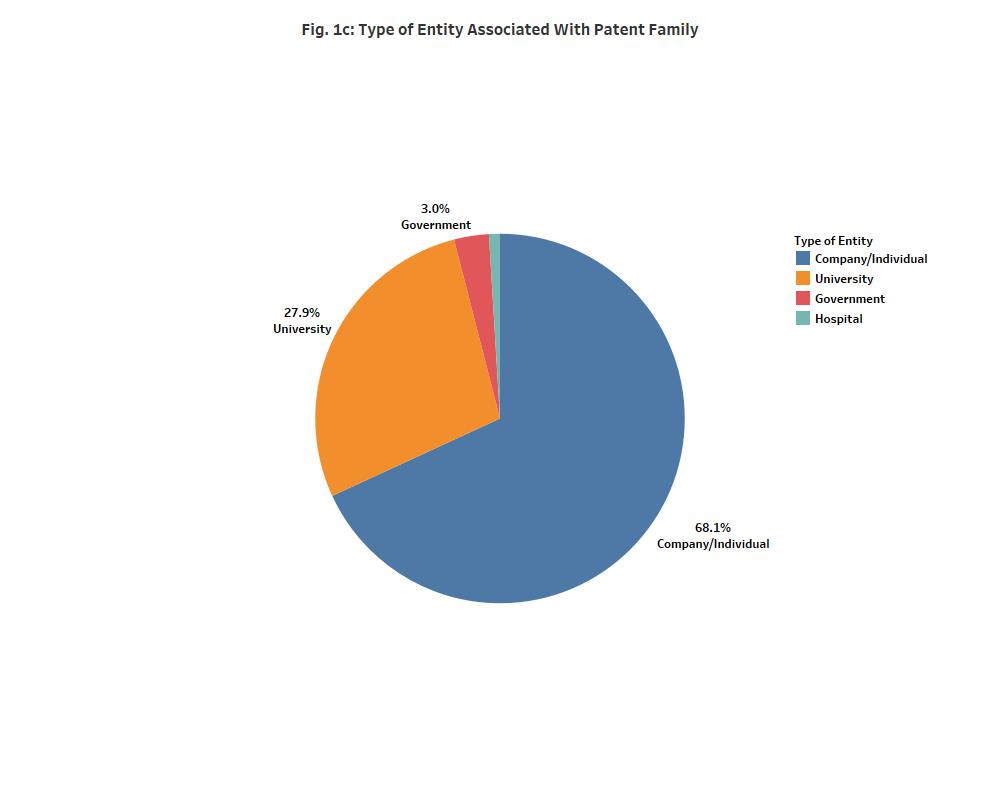

The patent family records were classified into companies/individuals, government/not-for-profit organizations, universities, and hospitals based on the primary assignee. Companies/individuals contributed to about 68% of the overall patent filings (Fig. 1c). Other entities contributing to the filings include universities (~28%), government/non-profit organizations (~3%) and hospitals (~1%).

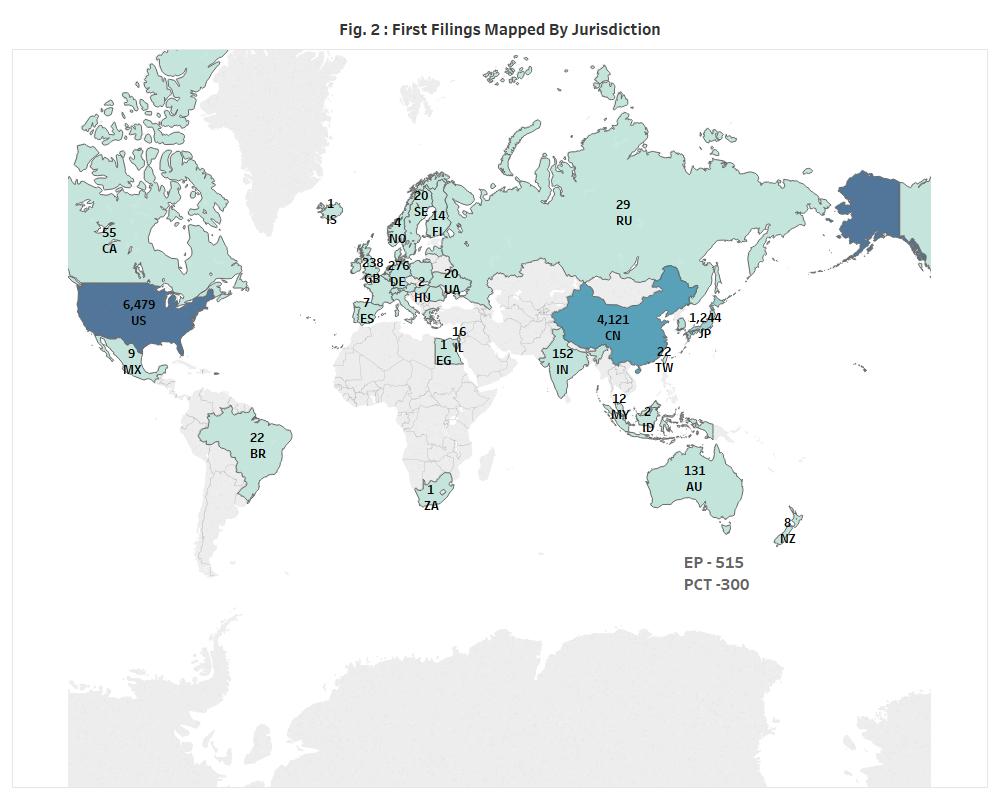

Most of the patent families originate from the United States (1st) , China (2nd) and Japan (3rd) (Fig. 2). European Patent Office (4th) and PCT (5th) filings also make up a significant number of first filings, suggesting that the entities seeking patents are looking at a global market.

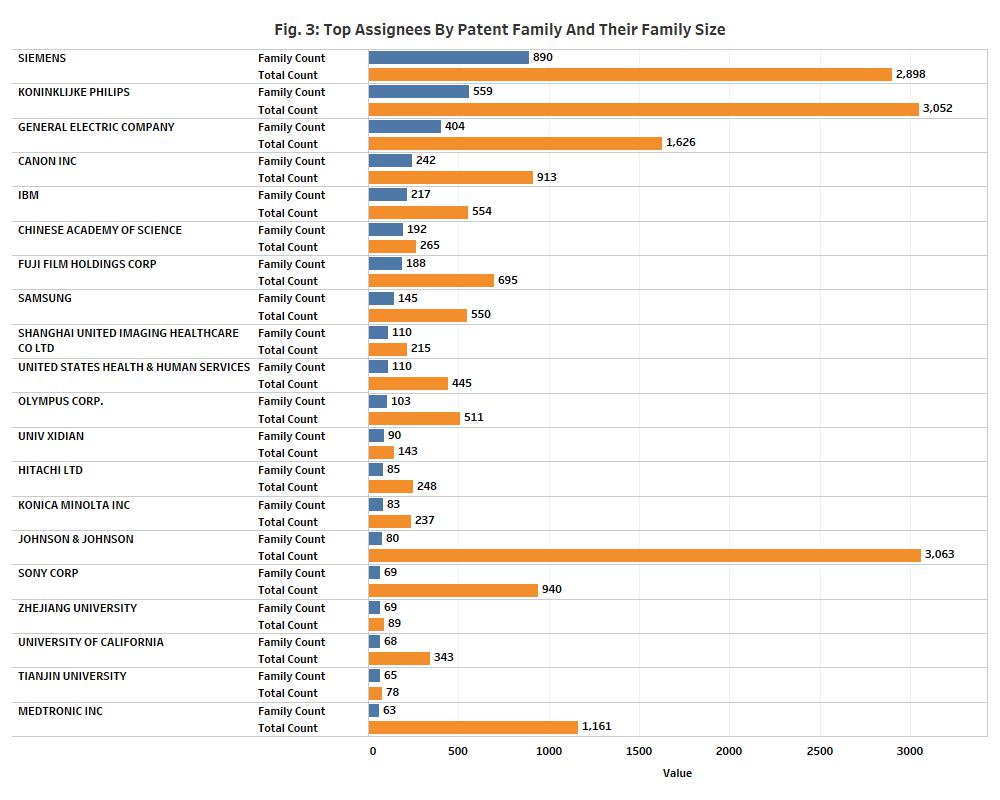

The top corporate assignees overall by patent family were Siemens, Philips, GE, Canon, IBM, Fuji Film, Samsung, Shanghai United Imaging Healthcare, Olympus, and Hitachi (Fig. 3). Other top assignees with a big portfolio were United States Health and Human Services and Chinese Academy of Sciences.

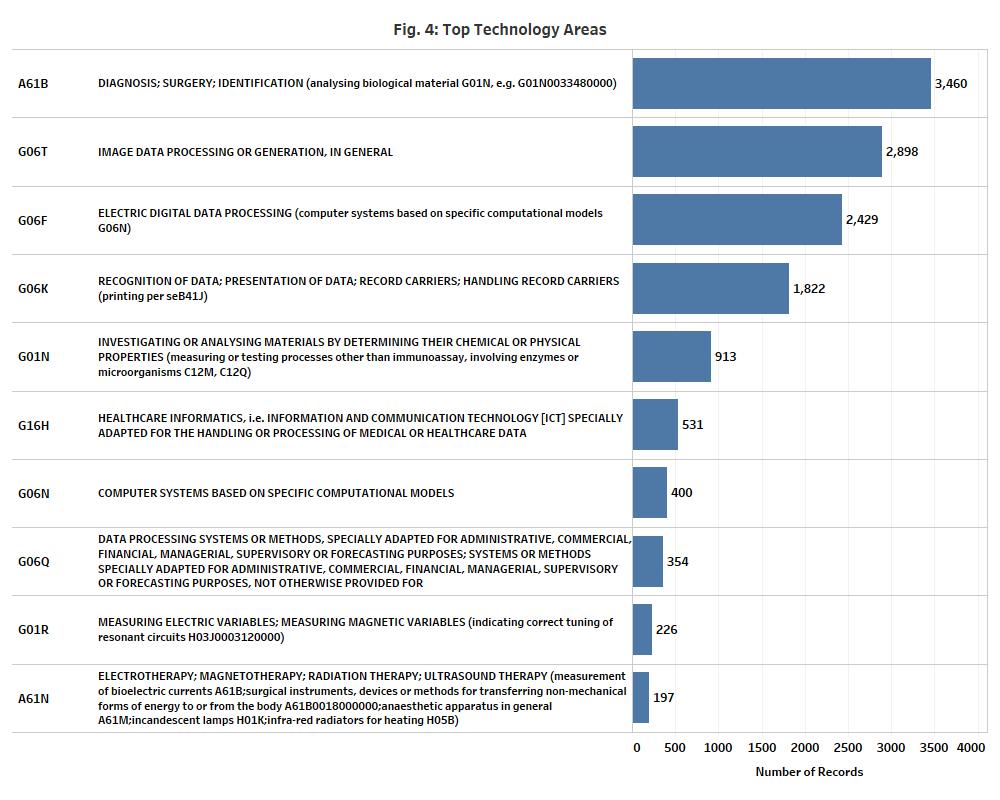

The top technology areas broadly were diagnosis; surgery; identification (A61B), image data processing or generation (G06T), electrical digital data processing (G06F), recognition of data; presentation of data; record carriers; handling record carriers (G06K), investigating or analysing materials by determining their chemical or physical properties (G01N), healthcare informatics, i.e. information and communication technology [ict] specially adapted for the handling or processing of medical or healthcare data (G16H), computer systems based on specific computational models (G06N), data processing systems or methods (G06Q), measuring electric variables; measuring magnetic variables (G01R), and electrotherapy; magnetotherapy; radiation therapy; and ultrasound therapy (A61N) (Fig. 4).

The National Institutes of Health recently assembled multiple relevant stakeholders to discuss the current state of knowledge, infrastructure gaps, and challenges for wider implementation of AI in medical imaging. To address the bottlenecks in translational research, the following priorities were recognized: (1) creating structured use cases, defining and highlighting clinical challenges solvable by AI; (2) setting up methods to encourage data sharing for training and testing algorithms to promote generalizability to widespread clinical practice and reduce unintended biases; (3) establishing tools for validating algorithms and monitoring their performance to facilitate regulatory approval; and (4) developing standards and common data elements for seamless integration of AI tools into existing clinical workflows.

Some of the top companies in the space and their recently showcased solutions are found below:

- Siemens Healthineers recently showcased its digital twin technology powered by AI that could be used to simulate a patient’s individual organ physiology and potentially, to predict changes and treatment outcomes. Siemens also presented 1) AI-Rad Companion Chest CT, an intelligent software assistant platform for helping radiologists interpret chest CT images by identifying and measuring organ lesions on chest CT images and automatically generating a quantitative report, and 2) AI-Pathway Companion, an AI-based clinical decision-support system.

- GE Healthcare’s solutions built on its AI platform, Edison, include AiRx (Artificial Intelligence Prescription) for MR, SonoCNS on Voluson, Centricity Clinical Archive and embedded Analytics, Automated Lesion Segmentation on LOGIQ, and Critical Care Suite for x-ray imaging, amongst others. AiRx uses deep learning algorithms that automatically identify anatomical structures to prescribe slices for routine and challenging neurological exams, improving productivity and delivering consistent results. SonoCNS automates the process of measuring the fetal brain which normally requires manual intervention. LOGIQ segments user-identified breast, thyroid or liver lesions, providing a trace of the lesion boundary and the corresponding area.

- Philips is focused on developments around Illumeo employing adaptive intelligence and IntelliSpace Portal to facilitate the development and deployment of radiology AI algorithms for clinical and translational research. Philips’ IntelliSpace Portal offers leading applications across a broad spectrum of clinical domains. The cardiology portfolio includes CT Cardiac Viewer, MR Cardiac and Multi-Modality Advanced Vessel Analysis. The oncology portfolio includes Invivo DynaCAD Prostate, CT Virtual Colonoscopy, and CT Liver Analysis. CT Brain Perfusion, MR Longitudinal Brain Imaging, and MR FiberTrak are part of the neurology portfolio. CT Pulmonary Artery Analysis, CT Lung Nodule Assessment, and CT COPD are part of IntelliSpace Portal’s pulmonology portfolio.

- Canon Medical’s Advanced Intelligent Clear-IQ Engine (AiCE) is the next generation of CT reconstruction technology. Labeled the world’s first Deep Learning Reconstruction method, Canon Medical’s Advanced Intelligent Clear-IQ Engine (AiCE) uses deep learning technology to differentiate signal from noise so that it can suppress noise while enhancing signal. AiCE is described to quickly produce stunning CT images that are exceptionally detailed and with the low-noise properties you might expect of a future advanced MBIR (Model-based Iterative Reconstruction) algorithm. In November 2018, Canon Medical Systems USA, Inc. introduced deep convolutional neural network (DCNN) image reconstruction for CT.

- IBM’s Watson Health Imaging is a provider of innovative cognitive computing, enterprise imaging, and interoperability solutions. Merge PACS is an AI-ready workflow platform that simplifies physicians’ reading activities and empowers IT leaders with advanced control of the flow of studies throughout the enterprise. Merge CADstream is the pioneer in breast MRI computer-aided detection (CAD), providing critical assistance to reading physicians by accelerating and simplifying the interpretation of large studies. On May 6, 2019, Hardin Memorial Health radiologists became the world’s first to “go live” with Watson powered Patient Synopsis, a radiologist-trained AI tool that helps to efficiently inform clinical care decisions.

- Fuji Film’s directives are focused on its REiLI medical imaging AI platform, such as Region Recognition for recognizing and extracting organ regions and computer-aided detection for reducing image interpretation time and supporting radiologists’ clinical decision-making.

- Samsung has recently featured several of its AI based diagnostic imaging integration capabilities such as the S-Detect for Breast, AI based software which analyzes breast lesions using ultrasound images which has been implemented into Samsung’s ultrasound systems dedicated to Radiology.

The Food and Drug Administration (FDA) is committed to ensuring the safety and efficacy of users of software as a medical device (SaMD). Under the new FDA proposal, products falling under adaptive AI and ML technologies will have to submit a predetermined change control with the premarket submissions. AI-based products in radiology can be broadly classified into those requiring only a 510K clearance and those requiring a premarket approval (PMA) including clinical studies. Selected approvals include:

- AI Contact application is a computer-aided triage software, a type of clinical decision support software, that uses an artificial intelligence algorithm to analyze CT images for indicators associated with a stroke and may notify providers. It was approved last year by the DeNovo pathway (DEN170073) and had also received a CE mark in Europe earlier.

- In April 2018, the FDA approved IDx-DR (DEN180001), the first cloud-based Retinal Analysis Artificial Intelligence Software which is effective in detecting mild levels of diabetic retinopathy without the need for a clinician to also interpret the image or results. It is usable by health care providers who may not normally be involved in eye care.

- Imagen’s OsteoDetect (DEN180005) is an adjunct tool used by a clinician to analyzes wrist radiographs using machine learning techniques to identify and highlight regions of distal radius fracture during the review of posterior-anterior (front and back) and medial-lateral (sides) X-ray images of adult wrists.

The growth projections for disruptive technologies, such as AI can vary significantly, due to the uncertain nature of the technology. One report pinned the market size of the AI healthcare market at $6.6 billion by 2021 with a CAGR of 40%. The AI imaging market in the US alone is estimated at $1.6 billion by 2025. The market drivers include the increasing amount of healthcare data, improved computing capabilities, and growing demand for personalized medicine. Potential barriers include the need for custom integration of AI into the hospital workflows, need for clinical validation studies, and untested regulatory process for AI solutions.

The continued growth and deployment of AI in the medical imaging industry is expected to occur through strategic partnerships between medical device giants, AI/tech giants, startups, chip companies, universities, hospitals, and government agencies. For instance, NVIDIA is partnering with several key players in the radiology industry such as GE healthcare, hospitals, and startups to facilitate AI adoption in its GPU-enabled platform for healthcare and medical imaging, NVIDIA Clara. GE healthcare is also collaborating with Intel for AI deployment in its CPU-based X-ray systems that scan for and detect pneumothorax within seconds at the point of care, allowing rapid response and reprioritization of an x-ray for clinical diagnosis.

It is estimated that AI has the potential to improve outcomes by over 50% while bringing down the cost of treatment by as much as 50%. Although research advances related to AI and ML are occurring at a quick pace, translation to clinical practice has been slow. It is clear from the patent filing trends, product development, regulatory changes, and market projections that AI in medical imaging is an area of major focus for diverse players including the established medical device companies, tech giants, emerging startups, universities, and hospitals. Within the next few years, artificial intelligence will transform radiology practice and bring the focus back to patients.

Stay tuned to our future updates related to AI and medical imaging landscape.